Ep. 044: How to protect your portfolio from a bear market

Humans have an ingrained herd mentality. When disaster hits, everyone checks to see what the person next to them is doing. We feel safe in the herd. But markets don’t reward the herd, they reward individuals. For an investor, watching stocks fall is a panic-inducing situation. But it’s the investors that don’t panic that come out on top when the market levels back out.

Download audio file by clicking icon above

“The fundamental issue with people losing money in markets isn’t that markets go up and down. It’s that people chase them instead of just owning it all.”

— Warren BuffetHumans have an ingrained herd mentality. When disaster hits, everyone checks to see what the person next to them is doing. We feel safe in the herd. But markets don’t reward the herd, they reward individuals. For an investor, watching stocks fall is a panic-inducing situation. But it’s the investors that don’t panic that come out on top when the market levels back out.

In this week’s conversation, we talk about:

✓ Why the patient always succeed in the market

✓ When you do what everyone else does, you get what everyone else gets

✓ How to build your portfolio in a way that reduces risk

✓ The importance of updating your risk strategies periodically

✓ Why “playing the market” is never a sound strategy

TO DIVE DEEPER INTO CRYPTOCURRENCY MARKET VOLATILITY:

The Hurricane House on Mexico Beach - New York Times

Episode 40: Debate On Bitcoin As A Hedge Against Inflation & Recession - SANE CRYPTO Podcast

The Periodic Table of Investment Returns - RCM Alternatives

QUESTIONS OR FEEDBACK:

Email: [email protected]

Twitter: @sanecrypto https://twitter.com/sanecrypto

SUBSCRIBE, RATE AND REVIEW:

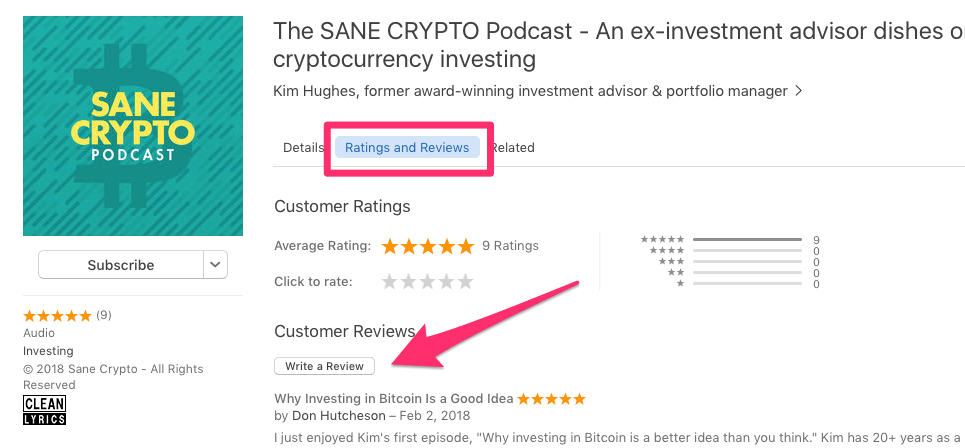

Hope you will subscribe so you don’t miss any episodes and, of course, give us an honest Rating and Review. I read each one and it helps tremendously to improve the show.

How To Leave a Review For The SANE CRYPTO Podcast:

1. Click ⇒ this link

2. When iTunes opens, click the Write A Review button (see below).