John, a 51 year old, SANE CRYPTO Podcast listener, from Oakland, CA, wrote to me about investing in alt-coins:

I know you are focused on the “big” coins. But I think we are seeing a class of other legitimate “use” coins starting to emerge…love to hear your comments on investing in alt-coins.

To understand my reasoning when deciding whether to invest in alt-coins, I think it is helpful to understand my perspective.

If you don’t know me, I am a former SEC registered investment advisor and financial engineer.

I was cutting my teeth, as an options trader, during the mid 90’s, in the run-up to the dot-com bubble, back when the Chicago Board Options Exchange was a bunch of guys standing around in pits yelling at one another. And yes, it was almost all guys!

I guess you could say my style is passive asset allocator. Which means putting together a team of different asset classes, in my portfolio, each serving a specific function…. doing a specific job, in order to achieve a specific long term goal.

Which, in my world, is to be able to do what you want, when you want, without worrying how to pay for it. That is my definition of financial freedom.

Once that allocation has been decided on, between the different asset classes, it doesn’t change.

There is absolutely no reason or event that would cause you to change the percentages allocated or get in and out of the market.

Unless: 1) your goals change; 2) your risk tolerance changes; or 3) in this case, a new asset class emerges that could serve a useful purpose in the portfolio.

Then and only then do you make changes to your portfolio structure. By design, we never, ever react, after the fact.

Show me an investor that reacts to news, or events, or market swings, by buying or selling, and I will show you an investor who is making less than the market return. Guaranteed!

I invest based on a set of guiding principles.

Principles are absolutely key because, in investing, NOTHING is certain. You can’t KNOW anything.

No one can!

You can only think. Only guess. Some guesses are more educated than others.

But, make no mistake… EVERYONE is guessing.

So how do we operate in an environment of great uncertainty?

Guiding principles. I won’t go through them all. But let me briefly touch on a few of mine:

1. Pigs get fat. Hogs get slaughtered.

This is the quintessential tightrope walk that is investing: Profit is the reward for risk.

A mis-step or bobble, to either side, can be catastrophic.

You need to make a double-digit return on your investments, to be able to live comfortably, for 40+ years, on your portfolio, in retirement.

If you invest too aggressively, you lose your nest egg and there isn’t enough time to recover. Don’t invest aggressively enough… and the result is the same.

Either way, you could end up, at 90 years old, living under a bridge, eating cat food!

So the goal is to find the sweet spot between risk and reward.

This principle reminds me, especially when greed rears its ugly head, that market karma is a bitch. And it never forgets.

This quote, from an article by an asset manager named James Doporre, on TheStreet.com, sums up my own, hard won experience:

“Above all else, we must respect the power of the market beast. Far too many market players try to pretend that investing or trading is easy. They claim to possess special skills or secret formulas that will guarantee that they will always outperform. The market will inevitably teach them they are wrong and that their success is only a temporary gift bestowed upon them if they respect the ultimate power of the market.”

Be humble. Be grateful. And you can make a very nice living.

Get arrogant. Or greedy. And the market will strike you down and rub your face in the dirt until it bleeds!

2. Plan for the worst. But hope for the best.

Not only do we have to walk the tightrope between profit and risk, we have to do it in a market that is, by definition, cyclical.

Markets are closed systems. The fundamental law of closed systems is that nothing can remain in a state of extreme indefinitely. i.e. markets are cyclical.

The pendulum will eventually swing. It always does.

And often, related to the principle above, just when people have finally given over rational thinking for greed.

The most important question you can ask as an investor is “What If … “.

Not just what if Bitcoin goes to a million. But what if Bitcoin goes to $100? What if … ??

Because both are possible.

This is why I always, always, always position myself so that I am OK, no matter what happens.

And, if I can’t create that balance, I don’t invest.

This is non-negotiable. To do otherwise is insane! I don’t get it.

I cover as many bases as possible.

During the financial crisis, people used to ask me, how do you sleep at night with so many investor’s futures riding on your shoulders?

I never, ever had an issue with the ones who stayed invested with me. I knew we had them positioned correctly. It was the ones that got so scared that I couldn’t talk off the ledge that made me hang up the phone and just sob.

Because I knew, the moment they hit the sell button, they were committing financial suicide. The sequence of returns problem meant there was absolutely no way for them to recover.

Create a portfolio that considers outcomes at both extremes and you can ride out the ups and downs relatively unperturbed.

3. This time is never different.

Therefore, the sane path is to assume this is a technology bubble. And assume it will eventually burst. As bubbles do… once it has served its function and run its course.

If you haven’t read AOL founder, Steve Case’s, The Third Wave: An Entrepreneur’s Vision of the Future, I highly recommend it.

It creates a great structure for thinking about the progression of the Internet as a disruptive technology. And it reminds us of what is likely to transpire when the First Wave of cryptocurrency crests and that bubble bursts.

If history is any guide, I believe it is completely rational to assume that 99% of crypto assets will fail, when it does, if not before.

Over 50% of 2017 ICOs have already failed and taken over $225 million of investor money with them.

84% of the Internet IPOs, back in the day, were gone 10 years later.

I believe, because the requirements to launch an ICO are far less costly and rigorous, that number will be much, much higher this time around.

And just like it was impossible, back then, to predict the Enrons, or the Worldcom’s or the Pets.com … and find the one Amazon or Netflix to emerge from the carnage… I know I can’t know which is the one needle in the haystack this time around either. No one can.

Although people make a lot of money and attract a lot of media attention pretending that they can. Which infuriates me.

4. I don’t believe in coin picking or market timing

To use some old saws, it’s “Time in the market, not timing the market”. And “Be the market. Not beat the market.” These truisms are truism because, well, they are true!

This is the hardest one for investors to wrap their brain around. Because:

1) Wall Street is based on the illusion, as good as anything conjured up on the Las Vegas strip, that they can… and spends $56B billion a year to promote that illusion, and …

2) Markets have the same addictive qualities as gambling or heroin. What causes addiction is random variable intermittent reinforcement. So the fact that technical analysis or stock picking, or anything else, only works often enough to make you think it is reliable, but not often enough to actually make you money … is offset by the big dopamine hit you get every time the slot machine lights up.

I could talk about this for days and days and days. But I’ll just give you a couple snippets …

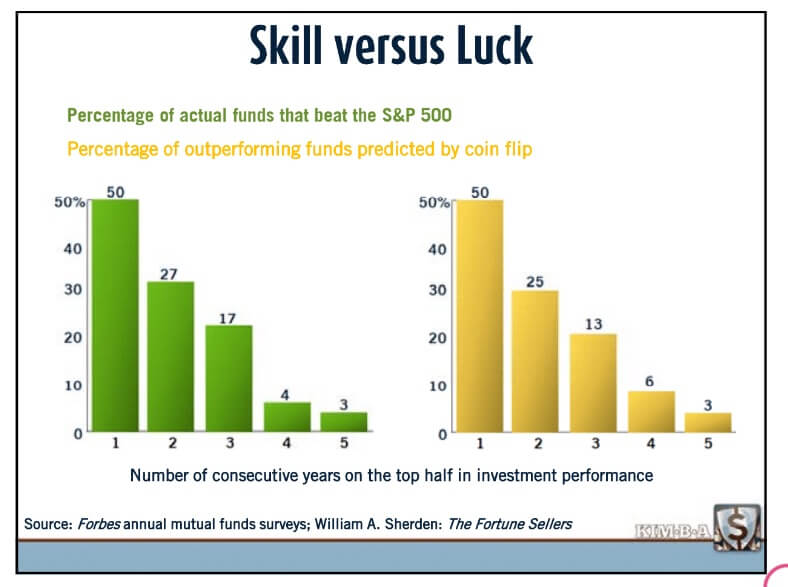

If someone could beat the markets, you would think it would be the mutual fund managers, who get paid millions of dollars a year to do exactly that, right? But they can’t.

Put a million monkeys in a room, flipping a coin… heads you beat the market, tails you don’t… and after one flip, 500,000 of them will have beat the market.

Of those another 250,000 will flip heads the second time, and half again and half again.

Not surprisingly, the number of mutual fund managers who beat the market, over consecutive period of years, is exactly the number predicted by a coin flip.

And this is true, whether we are talking stocks, cryptocurrency or pork bellies.

Second, again taking stocks as a proxy, because we have so much data to draw from on stocks that just doesn’t exist in the nascent crypto space … yet!

If you had bought and held the US stock market for the ten year period, from 1997 to end of 2006, you would have made a return of 8.46%. That’s just buy and hold.

If you missed just the five best days of that 10 year period, your return drops to 5.67%.

The 10 best days, 3.42%.

If you missed the best 20 days, out of 10 years, you were negative.

So, with that as background, and based on the criteria:

1) I want to be the market, not try to beat the market, because I know I can only do that by getting lucky, not through any particular skill

2) I must be able to set myself up so I am OK no matter what happens… because I have no idea what will happen

3) This is a long term play that I will be in until it either becomes non-viable as an asset class or it becomes my heir’s problem

The bet I want to make is on the future of cryptocurrency… Not the future of any one cryptocurrency.

If this were stocks, I could just own the S&P 500 index fund. But this isn’t stocks. We don’t have viable indexes. And we don’t have widely available, low cost index funds.

So, I try to get as close as possible to just owning the market, without taking on extra risk.

I think that is a market-cap weighted allocation, of no more than 2% of your total investable assets, to Bitcoin and Ethereum.

Together they represent 2/3rds of the total market cap. They have the benefit of Network Effect. And, particularly with Bitcoin, the Lindy effect.

I don’t need to go any further. Investing in alt-coins would be counter-productive.

If you assume, as I do, right or wrong, that 99% of these assets will fail, then every additional asset you add to the portfolio, beyond Bitcoin, adds exponential risk, without commensurate return.

Which doesn’t mean there aren’t, as John said in his original question, plenty of legitimate use cases. There may be.

I am just not willing to bet on any of them.

Because it wouldn’t be sane. At least not in my way of thinking.

Remember, this is not a game. It’s not a competition. It’s not entertainment.

When you are dealing with having to fund potentially 40+ years in retirement with the money you have managed to accumulate, investing is deadly serious business.

Something to consider. I hope you found it helpful …

◊ ◊ ◊

If you’d like to learn more about investing in cryptocurrency for retirement, I would encourage you to register for my free online training, How A Little, Little Bit of Bitcoin Can Make Your Retirement Savings Go A Lot, Lot Further.

As always. If you have any questions at all, about this topic, or anything else, just email me at [email protected]. I read and answer every email personally. Or leave it in the comments below.

◊ ◊ ◊